Technology is reshaping the financial services industry in significant ways. Innovations like fintech, mobile banking, and AI are enhancing user experiences and streamlining transactions. Traditional financial models face disruption from peer-to-peer lending and blockchain. However, these advancements also bring forth challenges, particularly regarding cybersecurity and regulatory compliance. The balance between innovation and security is critical. What implications do these changes hold for the future of financial interactions?

The Rise of Fintech: Redefining Financial Services

As the digital landscape continues to evolve, fintech emerges as a transformative force reshaping the financial services industry.

Peer-to-peer lending platforms disrupt traditional lending models, enabling individuals to connect directly and bypass intermediaries.

Meanwhile, blockchain technology enhances transparency and security, fostering trust in transactions.

Together, these innovations empower users with greater financial freedom, challenging established norms and redefining access to capital.

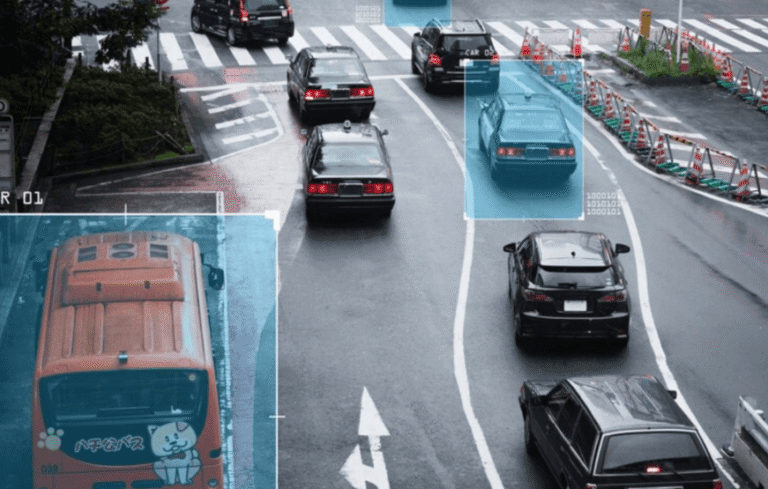

See also: How Smart Vehicles Are Enhancing Safety on the Roads

Mobile Banking: Convenience at Your Fingertips

The financial landscape has been significantly altered by advancements in technology, with mobile banking emerging as a key player in this transformation.

Mobile payment solutions enhance user experience, allowing consumers to conduct transactions seamlessly and securely from their devices.

This immediacy fosters financial independence, empowering users to manage their finances on-the-go while promoting an inclusive approach to banking that caters to diverse needs.

The Role of Artificial Intelligence and Big Data

Artificial intelligence and big data are revolutionizing the financial services sector by enhancing decision-making processes and personalizing customer experiences.

Institutions leverage these technologies for advanced fraud detection, significantly reducing losses and improving security.

Additionally, big data analytics enables tailored offerings, ensuring customers receive personalized services that meet their unique needs.

This shift not only enhances operational efficiency but also fosters greater customer trust and satisfaction.

Challenges and Risks in the Digital Financial Landscape

While artificial intelligence and big data enhance financial services, they also introduce a range of challenges and risks that institutions must navigate.

Cybersecurity threats have escalated, demanding robust defenses to protect sensitive information.

Additionally, maintaining regulatory compliance in a rapidly evolving digital landscape poses significant hurdles.

Financial institutions must balance innovation with security and adherence to regulations, ensuring sustainable growth in this dynamic environment.

Conclusion

As technology continues to reshape the financial services landscape, the balance between innovation and security becomes increasingly precarious. The promise of enhanced user experiences and personalized services is tempered by the looming threats of cybersecurity breaches and regulatory challenges. This duality raises poignant questions: Can the industry navigate these complexities to create a trustworthy digital environment? Ultimately, the future of finance hinges on the ability to harness technological advancements while safeguarding the integrity of the financial ecosystem.